Invoice of Sale

The invoice of sale a business generates to describe the products or services acquired by a customer precedes payment and production of a receipt. It normally includes a unique identification number, the product name, description, quantity, price, tax, date of purchase, payment due date, shipping cost and terms.

Some businesses do manage invoices manually, but when using an order management system, your records will be more accurate, and you can reduce time spent on repetitive tasks. You don’t need a separate invoice system when software like SOS Inventory allows you to manage everything related to your inventory, sales, and manufacturing all in a single, powerful platform at an affordable, monthly rate.

SOS Inventory’s invoices are similar to those you will find in QuickBooks Online; in fact, we designed our software to synchronize with QuickBooks Online to make tracking invoices and payments much easier.

When you create an invoice, you can send it to a printer, an email or QuickBooks Online. Invoices created in SOS and sent to QuickBooks Online will receive transaction numbers in QuickBooks Online if you enable customer transaction numbers in your QuickBooks Online account. (You will find complete details in our user guide).

SOS Inventory offers great inventory invoice software features to simplify the billing process and make QuickBooks Online integration a snap.

Create an Invoice from a Sales Order

Use SOS Inventory software to create invoices from your sales order by opening your sales order list and selecting the specific sales order you would like to process.

Use SOS Inventory software to create invoices from your sales order by opening your sales order list and selecting the specific sales order you would like to process.

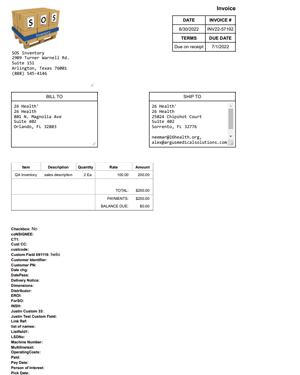

From the sales order, choose the actions menu and click the “create invoice” action. Only the items on the sales order that have been shipped but not yet invoiced will appear on the invoice. (Shipping must occur prior to creating an invoice of sale using the create shipment action on the sales order). The information used to create your purchase order will populate the sales invoice, i.e., company logo, company contact information, customer contact information, date, description, and quantity of items sold, cost, total cost, tax, discounts (if applicable), due date, and payment terms.

A sales invoice typically includes the following items and descriptions:

- Header: This includes the name and logo of the company issuing the invoice, as well as the invoice number, date, and any relevant customer information (e.g. name, address, contact information).

- Item description: This includes a description of the item being sold, such as the product name, model number, or SKU.

- Quantity: This indicates the number of units of the item being sold.

- Unit price: This indicates the price per unit of the item being sold.

- Total price: This indicates the total price for the quantity of items being sold, which is calculated by multiplying the quantity by the unit price.

- Taxes and fees: This includes any applicable taxes, shipping fees, or other fees that may be added to the total price of the items.

- Grand total: This is the final amount due, which includes the total price of the items plus any applicable taxes and fees.

- Payment terms: This indicates the payment terms and due date for the invoice, as well as any accepted payment methods.

- Notes: This includes any additional notes or comments related to the sale or invoice.

Although less common, listing the following items on a sales invoice improves transparency and clear communication:

- Payment terms: This refers to the agreed-upon terms of payment between the buyer and the seller. Including this on the invoice can help avoid confusion or disputes later on.

- Discounts: If a company is offering a discount to the buyer, it should be clearly stated on the invoice. This can help ensure that the buyer pays the correct amount and understands the terms of the discount.

- Shipping and handling fees: If a company charges for shipping or handling, this should be listed on the invoice. It helps the buyer to understand the total cost of the product and the fees associated with getting it delivered.

- Tax information: Depending on the country or state, sales tax may need to be collected and remitted by the seller. In such cases, it is important to list the tax amount and any other tax-related information on the invoice.

- Warranty or return policy: Including warranty or return policy information on the invoice can help protect both the buyer and the seller. It ensures that the buyer is aware of their rights in case of any issues with the product.

From the “Reports” tab, you can readily access the complete list of shipped sales orders awaiting invoice creation, keeping you on task and ensuring your finance department sends out all invoices on time.

Q: What is the difference between a sales invoice and a purchase order?

A: A purchase order represents a request for goods or services, but the sale has not yet transpired. If you place an order for something without paying for it, that transaction is a purchase order. Once there is sales agreement for goods or services at a certain price and under certain conditions, the invoice of sale can occur.

SOS Inventory generates both the purchase order and invoice.

A: What’s the difference between a sales order and a receipt?

Q: A sales order (bill) indicates an agreement to purchase goods or services at specific price and terms prior to payment. A receipt is proof of payment for those goods or services.

An invoice of sale indicates incoming revenue (accounts receivable) to your finance department and allows decision makers to plan for future company expenditures. Invoice tracking is important for staying on top of delinquent customer payments and cash flow.

SOS Inventory simplifies the sales invoice process with extensive order management features designed to streamline workflows, track all stages of an order along with quantities and costs. Inventory invoice software features simplify order tracking. For greater control over inventory, sales, and financial planning, count on SOS Inventory to manage the fine details of your business.